The average publisher on the internet sells its inventory through 15 supply paths. Our research shows that those paths create a pricing inefficiency that savvy buyers can exploit.

Buying Through One, Selling Through Many

The programmatic supply chain is famously fragmented, and both buyers and sellers have a multitude of potential technology partners to power their advertising operations. But the procurement choices of buyers and sellers could not be more different. When buyers select a bidding platform, their rational choice is to select a single DSP. By centralizing all bidding through a single DSP, buyers can execute a well-orchestrated marketing plan that delivers the best possible user experience and the best possible marketing ROI.

Sellers see the world very differently. For sellers, the rational choice is to monetize inventory through many exchanges. By conducting multiple auctions through multiple different exchanges, sellers maximize the yield of each available impression. Said simply, buyers want to buy through a single platform, but sellers want to sell through as many platforms as possible.

Supply Chain Complexity

Header bidding enables publishers to conduct simultaneous auctions for the same impression, creating a supply chain that has multiple paths to a single impression. In a simple example, a publisher might partner with three exchanges, creating three paths to supply:

The earliest adopters of header bidding used a client-side implementation that required the user’s browser to initiate auctions with each of the publisher’s ad exchange partners. By occupying the user’s browser with ad tech tasks, client-side header bidding implementations introduced page load latency and created a user experience penalty. To overcome this penalty, publishers are now adopting server-side header bidding solutions that occupy a single browser connection and dispatch all auction requests from a server-side wrapper. These servers are of course much more scalable than a user’s browser, making it possible for the publisher to initiate even more auctions for each impression. In a simple example, a publisher utilizing a server-side header bidding wrapper might partner with five exchanges, creating five paths to supply:

Publishers also commonly operate a hybrid ad serving configuration that includes a mixture of client-side and server-side header bidding, often through multiple wrappers. In these scenarios, it is common for the publisher to integrate a single exchange multiple times. Building on our earlier example, a publisher might partner with five exchanges, but create six paths to supply:

Additionally, it is common for publishers to have indirect relationships with exchanges, who are authorized to resell impressions. In these configurations, the publisher might choose not to directly integrate with ad exchange F, but instead authorize exchange F to resell impressions made available by ad exchange B. Our sample publisher now has six exchange partners who create seven paths to supply:

This example is not an outlier. In fact, it is one of the simpler configurations we observe when studying major ad-supported publishers. Through analysis of publicly-available ads.txt files, we are able to observe the paths by which major publishers make their inventory available. The New York Times, for example, sells its inventory through 6 directly-integrated RTB ad exchanges, who collectively create 11 supply paths:

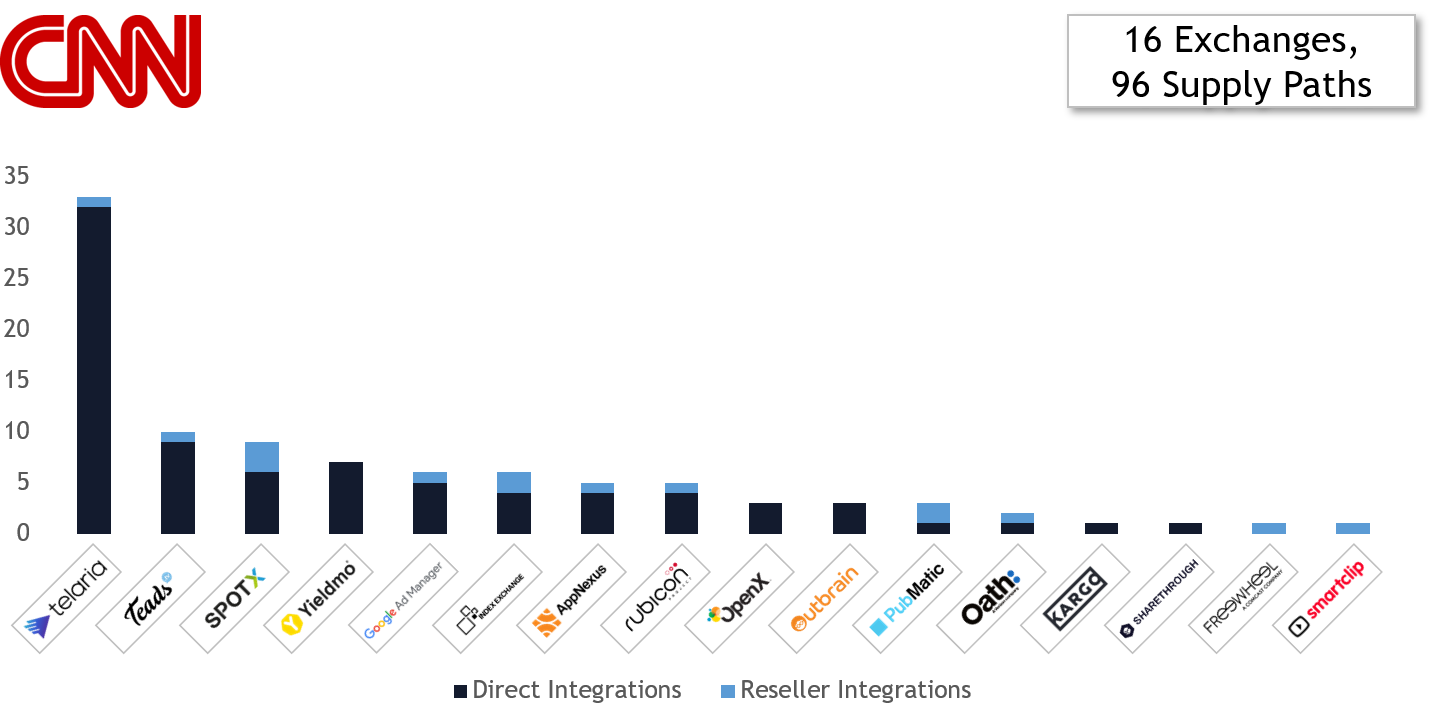

CNN partners with 16 exchanges through a combination of direct and reselling relationships. Collectively, these 16 exchanges create 96 different paths by which buyers can access CNN’s inventory.

SF Gate partners with 29 exchanges, who collectively create 347 supply paths:

We have studied ads.txt files published by the 2,000 largest global websites as reported by Alexa. We have further augmented this list of publishers with all ads.txt files from the 100 largest programmatic supply sources for Jounce’s buy-side customers. We then cleaned this data to both normalize vendor names and scrub non-RTB partners. Based on this analysis, we find that 88% of publishers sell their inventory through multiple supply paths. The median publisher in our data set partners with 15 different RTB exchanges.

Knock-On Effects Of Complexity

For buyers, supply path complexity creates three challenges.

First, a complex supply path introduces significant infrastructure cost. As publishers conduct multiple auctions for the same impression, DSPs are burdened with artificially inflated QPS requirements. DSPs and their investors care very much about this infrastructure burden. Marketers and their agencies care only to the degree that elevated DSP operating costs result in elevated DSP fees.

Second, a complex supply chain creates bad incentives for ad exchanges. In an environment where exchanges are in head-to-head competition for each ad impression, any edge that produces an elevated bid price can create significant share shift. Bid caching, as one example, is a technique that enabled an exchange to produce above-market prices for its publisher partners. But bid caching is made possible by misusing advertiser bids and manipulating auction outcomes. Unlike the infrastructure cost issue, which only indirectly affects marketers, bad incentives create trust and transparency concerns that very directly impact buyers.

Third, and most critically, a complex supply chain creates pricing inefficiency. Because of variations in the fees, auction mechanisms, and integration configurations of each supply path, publishers often award impressions to a low-price bidder. To illustrate this point, we conducted a series of controlled bidding experiments on a major US publisher who exposes nine supply paths through five directly-integrated RTB exchanges. Their supply map looks like this:

Using a major DSP, we submitted a static $2.00 CPM bid price into each supply path, and we were cautious to ensure we never bid against ourselves for the same impression. Through ad exchange A, fewer than 1% of our $2.00 CPM bids resulted in an impression. Through one of ad exchange E’s integrations, nearly 30% of our $2.00 CPM bids resulted in an impression.

We believe this data suggests that our $2.00 bids into exchange A commonly lose to sub-$1.00 bids submitted by our competitors into exchange E. The opposite is of course also true. We believe our $2.00 bids into exchange E commonly beat $5.00-$10.00 bids from our competitors who are bidding into sub-optimal supply paths. We have conducted similar experiments across dozens of other publishers and consistently find similar degrees of pricing inefficiency.

Exploiting Pricing Inefficiencies

Buyers who want to exploit the pricing inefficiency of RTB supply paths have three options.

Strategy 1: Direct-To-Pub

The most aggressive strategy for exploiting exchange-based pricing inefficiency is to eliminate exchanges entirely and transact directly with the publisher. Criteo, a pure play DSP, is directly integrated with 31% of the publishers we studied. In different ways, Amazon, AppNexus, and Google are all adopting a direct-to-publisher strategy for their DSP businesses. We expect to see more DSPs follow this path in 2019.

Strategy 2: Strategic Alliances

An alternative approach to managing supply path inefficiency is to form strategic alliances with a short list of ad exchanges. Buyers approach these strategic alliance discussions from a position of strength, with many potential ad exchange partners eager to gain access to exclusive buyer demand. In our work with RTB buyers, we see a growing precedent for exchanges to offer incentives in the form of auction data and auction priority to buyers who make supply path commitments.

Strategy 3: Algorithmic Optimization

Algorithmic optimization is the most complex approach, but is also likely the most financially attractive to buyers. Through algorithmic optimization, buyers identify the optimal supply path for every publisher on their media plan and submit 99% of bids through this optimal path. The buyer, however, continues to submit 1% of bids through non-optimal paths in order to detect changes in the market. When the buyer determines that the optimal supply path has shifted, it automatically redirects its 99% sample to that new optimal path.

The Programmatic Atlas

If you’re going to optimize your path to supply, you’re going to need a map. So we made one. We call it the Programmatic Atlas, and it contains daily refreshes of supply path audits for the largest publishers on the internet. We’ve exposed the Programmatic Atlas through both a web-based dashboard and a Google BigQuery database. Both are publicly available and free to use at jouncemedia.com/programmatic-atlas.